Author: Sachin Gupta | Find me on Twitter Follow @sach_gupta

Have any Questions? Tweet to @sach_gupta

The mood in the country since 2013 was of pessimism. Consumers had postponed their decision to purchase goods and invest in assets, businesses had put a break on investing in new projects, job creation was at an all time low, GDP had plummeted to a 4.5% level, inflation had been as stubborn as a 3 year child, and bureaucrats had stopped moving the files. The buzz word was Election…Election…and Election.

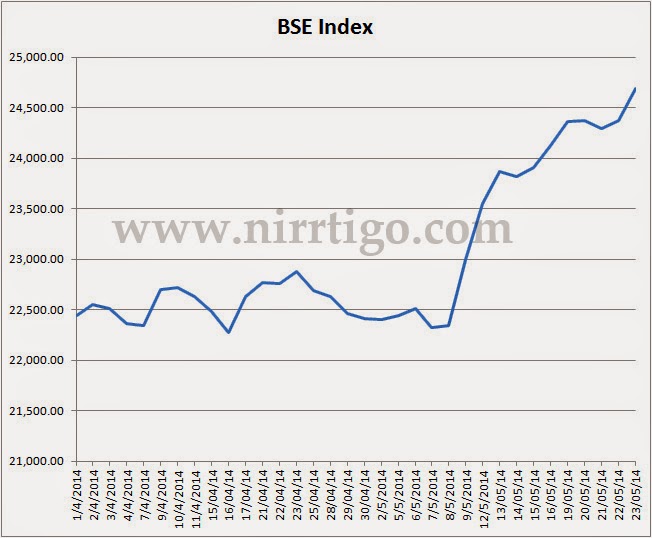

Now that, Elections are done with, what is the current state of mood in the country? Prime Minister designate Narendra Damodardas Modi will take charge today 26th May 26, 2014. Does he posses the magic wand to cure all the ills plaguing the Indian economy today? Then, how the hell this mood and subsequently the economy will improve? What will be the trigger that will make fence sitting consumers to buy goods? What will enable businesses to invest in new projects? Well, again, it’s that magic thing called “Mood”…and no, we are not talking about the Moods condoms…..what we are talking about is the feeling of optimism among countrymen. Has it changed already from pessimism to optimism? Stocks markets seems to suggest so….the sheer size of BJP led NDA victory has enthused the capital markets and according to some experts this could be the beginning of mother of all bull runs that this country has ever seen.

Why are stock markets so upbeat about Narendra Modi? Decisive; able administrator; and economic development are some of the adjectives that are used to describe him. In my opinion, however, it seems he wants to go down as the greatest political leader in India since Mahatma Gandhi; it is this urge or fire which is driving him. And this urge has resulted in a hope and this hope which spreads like a viral can create infectious optimism and excitement, consumers will again start purchasing, businesses will start new projects, and bureaucrats will become efficient.

According to Keynesian Economics, There are 2 aspects to revive a faltering economy, one is by increased government expenditures and lower taxes to stimulate demand and pull the economy out of the Depression, and the second is Animal Spirit.

Post 2008 world financial crisis, UPA-II under Manmohan Singh implemented only one aspect of Keynesian model by increasing government spending to boost demand. Which of course stretched the fiscal deficit and that resulted in high inflation and high interest rates after 2011. However, they overlooked or were incapable to raise public sentiments or hope. Result, According to Planning commission data, GDP grew by 8.59 % in 2009-10, by 9.32 % in 2010-11, and then started to come down to 6.21 % in 2011-12, 4.99 % in 2012-13, and in 2013-14 it is expected to be at 4.5%. Had they improved public sentiments, things would have been different today.

Modi Government has raised hopes but he has to ensure that these expectations are complemented by action on ground. Because, make no mistake, without any substantive action, hope will soon dither.

Follow @sach_gupta

Now that, Elections are done with, what is the current state of mood in the country? Prime Minister designate Narendra Damodardas Modi will take charge today 26th May 26, 2014. Does he posses the magic wand to cure all the ills plaguing the Indian economy today? Then, how the hell this mood and subsequently the economy will improve? What will be the trigger that will make fence sitting consumers to buy goods? What will enable businesses to invest in new projects? Well, again, it’s that magic thing called “Mood”…and no, we are not talking about the Moods condoms…..what we are talking about is the feeling of optimism among countrymen. Has it changed already from pessimism to optimism? Stocks markets seems to suggest so….the sheer size of BJP led NDA victory has enthused the capital markets and according to some experts this could be the beginning of mother of all bull runs that this country has ever seen.

Why are stock markets so upbeat about Narendra Modi? Decisive; able administrator; and economic development are some of the adjectives that are used to describe him. In my opinion, however, it seems he wants to go down as the greatest political leader in India since Mahatma Gandhi; it is this urge or fire which is driving him. And this urge has resulted in a hope and this hope which spreads like a viral can create infectious optimism and excitement, consumers will again start purchasing, businesses will start new projects, and bureaucrats will become efficient.

According to Keynesian Economics, There are 2 aspects to revive a faltering economy, one is by increased government expenditures and lower taxes to stimulate demand and pull the economy out of the Depression, and the second is Animal Spirit.

Post 2008 world financial crisis, UPA-II under Manmohan Singh implemented only one aspect of Keynesian model by increasing government spending to boost demand. Which of course stretched the fiscal deficit and that resulted in high inflation and high interest rates after 2011. However, they overlooked or were incapable to raise public sentiments or hope. Result, According to Planning commission data, GDP grew by 8.59 % in 2009-10, by 9.32 % in 2010-11, and then started to come down to 6.21 % in 2011-12, 4.99 % in 2012-13, and in 2013-14 it is expected to be at 4.5%. Had they improved public sentiments, things would have been different today.

Modi Government has raised hopes but he has to ensure that these expectations are complemented by action on ground. Because, make no mistake, without any substantive action, hope will soon dither.

Will he be able to deliver and fulfill these expectations???

Have any Questions? Tweet to @sach_gupta