Author: Sachin Gupta | Find me on Twitter Follow @sach_gupta

Have any Questions? Tweet to @sach_gupta

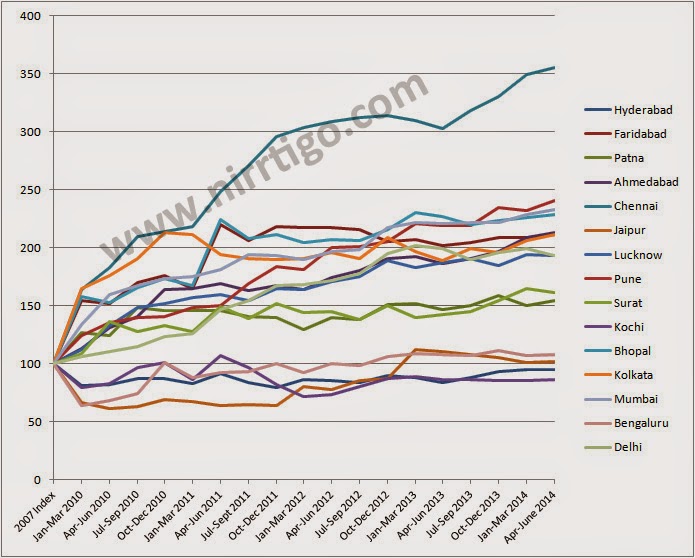

This post deals with commercial real estate in India. For the last 2 years, one would have noticed that most real estate developers and private equity funds have focused their energies on development of residential real estate across India.

Why did this happen? Why did real estate developers in last 2 years solely focus on residential real estate? Well, the answer lies in global economic slowdown. Due to global economic slowdown, companies started to lay off employees and there was freeze on investment in new projects. And all of this resulted in lack of demand for commercial office space by companies. Due to lack of demand of office space, developers ignored the commercial real estate and that has resulted in tight supply of office space.

And now that, economy is starting to show signs of recovery, there is again demand for office space and therefore it is pushing up the prices of commercial real estate. So, the situation now is – demand is increasing but supply is tight. And in this condition, rentals are bound to go up.

Why does this happen? Why do we sometimes see oversupply of commercial real estate and sometimes tight supply? It is because of the cyclical nature of the real estate industry. Some underlying facts regarding the commercial real estate are:

Why does commercial real estate development follow a cyclical pattern? During the boom time, when local real estate developers and investors sense that vacancy rates are declining and rents are rising, they believe more development may be feasible. Consequently, developers begin to analyze markets to determine if additional space, if developed, can be leased profitably. Because many competing developers may sense this opportunity simultaneously, they may all begin to develop at once in order to satisfy the demand. Even though there may be a definite need for additional space, the potential for over-development will exist as each developer rushes to deliver additional space to the market before competitors. There is no way to determine exactly how much space should be developed because the depth and extent of demand are difficult to predict. As a result, commercial real estate is sometimes said to be prone to periodic cycles of over-development.

One would have seen during the 2004-2008 boom time in India, when plethora of shopping malls came up in Mumbai, Delhi NCR, Bangalore, Chennai, and other economic centers in India. Because there was demand for retail space, developers jumped up and created an oversupply of malls across India. The important point to notice is that it is very difficult to predict the exact demand and therefore oversupply will happen in commercial real estate.

On the other hand, when economy is going down and growth is shrinking, developers may ignore the development of commercial real estate because of lack of demand from companies. However, as soon as, economy picks up, the tight supply of commercial real estate again pushes up the rentals and vacancy rates starts to fall.

And the cycle continues like this. There will be periods of oversupply and there will be periods of tight supply.

Let’s analyze this diagram above.

One full cycle takes 5-6 years and all the 4 steps mentioned above repeat themselves.

Follow @sach_gupta

Why did this happen? Why did real estate developers in last 2 years solely focus on residential real estate? Well, the answer lies in global economic slowdown. Due to global economic slowdown, companies started to lay off employees and there was freeze on investment in new projects. And all of this resulted in lack of demand for commercial office space by companies. Due to lack of demand of office space, developers ignored the commercial real estate and that has resulted in tight supply of office space.

And now that, economy is starting to show signs of recovery, there is again demand for office space and therefore it is pushing up the prices of commercial real estate. So, the situation now is – demand is increasing but supply is tight. And in this condition, rentals are bound to go up.

Why does this happen? Why do we sometimes see oversupply of commercial real estate and sometimes tight supply? It is because of the cyclical nature of the real estate industry. Some underlying facts regarding the commercial real estate are:

- It is a very large market and it is highly competitive

- Ownership of commercial real estate is highly fragmented across the country

Why does commercial real estate development follow a cyclical pattern? During the boom time, when local real estate developers and investors sense that vacancy rates are declining and rents are rising, they believe more development may be feasible. Consequently, developers begin to analyze markets to determine if additional space, if developed, can be leased profitably. Because many competing developers may sense this opportunity simultaneously, they may all begin to develop at once in order to satisfy the demand. Even though there may be a definite need for additional space, the potential for over-development will exist as each developer rushes to deliver additional space to the market before competitors. There is no way to determine exactly how much space should be developed because the depth and extent of demand are difficult to predict. As a result, commercial real estate is sometimes said to be prone to periodic cycles of over-development.

One would have seen during the 2004-2008 boom time in India, when plethora of shopping malls came up in Mumbai, Delhi NCR, Bangalore, Chennai, and other economic centers in India. Because there was demand for retail space, developers jumped up and created an oversupply of malls across India. The important point to notice is that it is very difficult to predict the exact demand and therefore oversupply will happen in commercial real estate.

On the other hand, when economy is going down and growth is shrinking, developers may ignore the development of commercial real estate because of lack of demand from companies. However, as soon as, economy picks up, the tight supply of commercial real estate again pushes up the rentals and vacancy rates starts to fall.

And the cycle continues like this. There will be periods of oversupply and there will be periods of tight supply.

Let’s analyze this diagram above.

- When economy is in recovery phase, the demand for commercial real estate increases which reduces the vacancy rates and rentals go up.

- Seeing the fall in vacancy rates and improving rentals, developers start developing the additional space. Rentals start to cool off because there is supply of additional space.

- However, because it is difficult to predict the actual demand, the oversupply of space is seen in the market. Rentals fall.

- Increasing vacancy rates and falling rentals drive away the developers from developing the commercial real estate and supply is tightened.

One full cycle takes 5-6 years and all the 4 steps mentioned above repeat themselves.

With this in mind, can you time the market as far as investment is concerned??

Have any Questions? Tweet to @sach_gupta